Hey there! This is a 🔒 subscriber-only edition of ADPList’s newsletter 🔒 designed to make you a better designer and leader. Members get access to exceptional leaders' proven strategies, tactics, and wisdom. For more: Get free 1:1 advisory | Become an ADPList Ambassador | Become a sponsor | Submit a guest post

Friends,

Lately, I’ve been reading a lot about how 2025’s job market is rewriting compensation narratives. Every time I open LinkedIn or talk to someone from my network, one thing keeps popping up - people aren’t just choosing where to work anymore but they’re questioning how they get paid. And suddenly, the old comfort of a stable paycheck seems to be in competition with the long-game promise of equity. I’m seeing this trend rising more & more recently.

This hit home when a friend recently shared that she turned down a $60K salary at a global cosmetics firm in favor of a $40K + equity offer from a stealth startup in New York. Her logic? “If this goes right, I could make 5x more in three years.” And that made me pause. Would I have made the same bet? Or played it safe?

I started digging deeper, I read compensation breakdowns, talked with peers in tech, marketing, and design, and even compared offer letters I had seen. The data was clear: companies are being creative. Startups are bouncing back after the VC winter and dangling equity like candy, while big corporations are tightening salary packages and shifting toward performance-based rewards.

The more I read, the clearer it became that this isn’t just about choosing between salary and equity. It’s about understanding your risk appetite, career stage, and long-term goals.

I did some research on this and here are the key insights -

Salary vs. equity-based compensation:

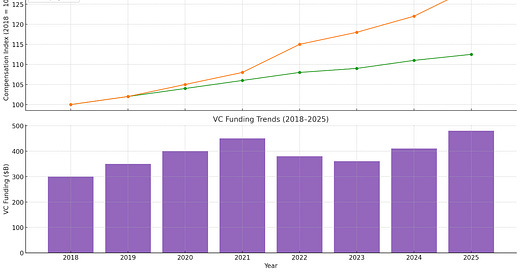

The average tech salary in 2025 is $112,521, marking a modest 1.2% year-over-year increase.

Equity compensation has grown by 6% in 2025, reflecting a continued emphasis on stock-based incentives.

However, there's a shift towards cash-based pay due to economic conditions and increased scrutiny of stock-based compensation.

VC funding trends:

Global venture funding reached $113 billion in Q1 2025, a 17% increase quarter-over-quarter and a 54% increase year-over-year.

Late-stage investments, particularly in AI startups, have driven this growth, with AI-native startups accounting for nearly half of global venture deal value in 2024.

And just like how we often panic-scroll about the “death” of UX jobs without seeing the full picture (remember how hiring was still 65% of 2021 levels at its lowest?), we sometimes dismiss equity as “too risky” or salary as “too boring.” But the truth sits somewhere in between.

So, in this edition, I’m diving deep into the salary vs. equity dilemma—backed by data, real stories, decision frameworks, and what you should really bet on in 2025. ⬇️

The compensation landscape in 2025

📌 A breakdown of what companies are offering today -

If you’re navigating job offers in 2025, you’ve probably noticed something odd: that $70K salary you were expecting? It might now come with a caveat especially if you're applying to startups. Compensation packages aren’t just numbers anymore, they’re strategies. And companies are playing chess.

I’ll make it easy for you -

📉 Startups — After enduring the so-called “VC winter” of 2022–2023, startups are now leaner, smarter, and more cautious with cash flow. That translates into base salaries being 20–50% lower than market average, but they’re making up for it by offering generous equity packages. The goal? Hire talent that’s aligned with long-term growth and willing to take a bet on it.

📈 FAANG & corporate giants — Big players like Google, Amazon, and Meta are keeping base salaries competitive but tying performance to RSUs (Restricted Stock Units). These often vest over four years and serve as a golden handcuff, offering security and stability. You're not getting rich overnight, but you’re earning predictably and with less risk.

In a recent 2024 report by AngelList, 63% of employees under 30 said they’d consider a lower salary in return for a higher equity stake especially if the startup had promising growth indicators. For Gen Z and younger millennials, the upside potential of owning a piece of something bigger is worth the short-term financial hit. This number was just 41% in 2021. That’s a massive shift in mindset within four years.

What is equity? What types exist?

Before we talk numbers, let’s talk definitions:

Equity is essentially ownership in a company. When you're offered equity as part of your compensation, you're being invited to share in the future success/failure of the business. But equity isn’t one-size-fits-all. The type you’re offered dramatically impacts what you actually get!

Let me explain how ⬇️

Stock options

Stock options give you the right to buy shares at a fixed price (called the strike price) after you’ve worked at the company for a certain time.

ISOs (Incentive Stock Options) – Mostly for employees, these come with preferential tax treatment in many countries but have restrictions on who qualifies and how they’re exercised.

NSOs (Non-Qualified Stock Options) – Offered to employees, advisors, and contractors. Easier to issue, but usually taxed as ordinary income when exercised.

Risk: You pay out of pocket to buy the shares. If the company fails, you're left with worthless stock.

RSUs (Restricted Stock Units)

RSUs are promised shares that vest over time. You don’t have to buy them—they’re granted.

Popular in large corporations like Google and Amazon.

You receive the shares outright once vested, but they’re taxed as income when delivered.

Best for: Employees who prefer predictability and lower financial risk.

ESOPs (Employee Stock Ownership Plans)

Used in some startups and private companies, ESOPs are retirement-focused plans where employees accumulate shares over time, often without upfront costs.

You may receive distributions when you leave or retire.

Not common in high-growth tech startups but often seen in legacy businesses and scale-ups

***

The real math behind equity: How much is that 0.5% worth?

Well, equity sounds great until you try to figure out what it actually means.

When someone says, “You’ll get 0.5% equity,” it sounds like a golden ticket. But is it really? Let’s break it down with some back-of-the-envelope math.

Say you join a Series A startup valued at $10 million. They offer you 0.5% equity.

That’s $50,000 on paper today. Not bad, right?

Now, let’s fast-forward 5 years:

The startup grows and raises more rounds, and now it's valued at $300 million at exit. Assuming your shares haven’t been diluted beyond that 0.5% (which is optimistic), your stake is now worth $1.5 million.

But here’s the catch, and it’s a big one.

Dilution is real. Every new funding round eats into your slice. After a Series B and C, your original 0.5% could shrink to 0.15–0.2%, unless you have pro-rata rights (rare for employees). So your exit money might be closer to $450,000–$600,000 (still great, but not life-changing for most.)

Vesting matters. You usually only own the equity after four years with a one-year cliff. Leave before that? You get nothing.

Taxes eat a chunk. Depending on your country, exercising options and selling shares could trigger capital gains taxes, income taxes, or both.

Here’s a quick equity math framework you can apply before saying yes — “Equity Worth Estimator” framework: